Gaurav Jain is India’s leading Wealth Expert. Coming from a business family based in

Lucknow, he

has 15+ years of Global experience working with top corporates like ICICI Bank and Cafe Coffee Day,

as well as Fortune 500 Companies like Citibank and P&G.

With a mission to help people live a life of financial abundance, he quit the

corporate world in

2015 to pursue his passion and founded Indycapital, a wealth management firm in Lucknow.

His unique understanding of both business and salaried mindsets helped him identify a critical

gap: people work very hard for money, but find it challenging to manage it.

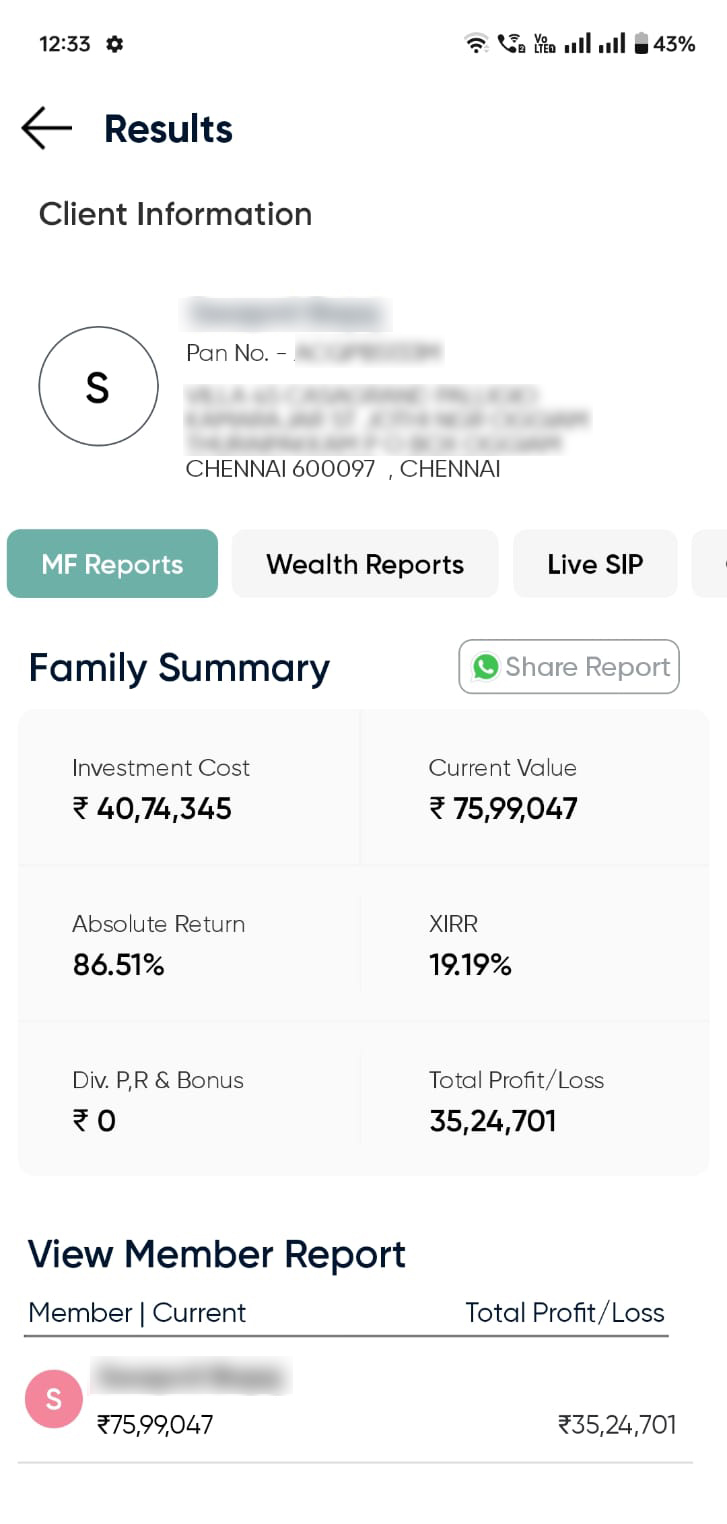

Today, he and his firm manage over ₹200 crores for hundreds of clients in 15

countries.

He also has experience in managing corporate treasuries that sets him apart from

others, offering

businesses expert solutions to handle finances in international markets effectively.

Gaurav's regular appearances in leading newspapers and radio podcasts have made him a trusted voice

in finance for his listeners.

Through his personalized guidance, he has helped over 200 families reduce debt, create

passive

income, and even become crorepatis. His global approach and hands-on support

have brought financial abundance to many, showing them how to grow their money the right way.

video to

see why people from 15+ countries trust Gaurav.

video to

see why people from 15+ countries trust Gaurav.

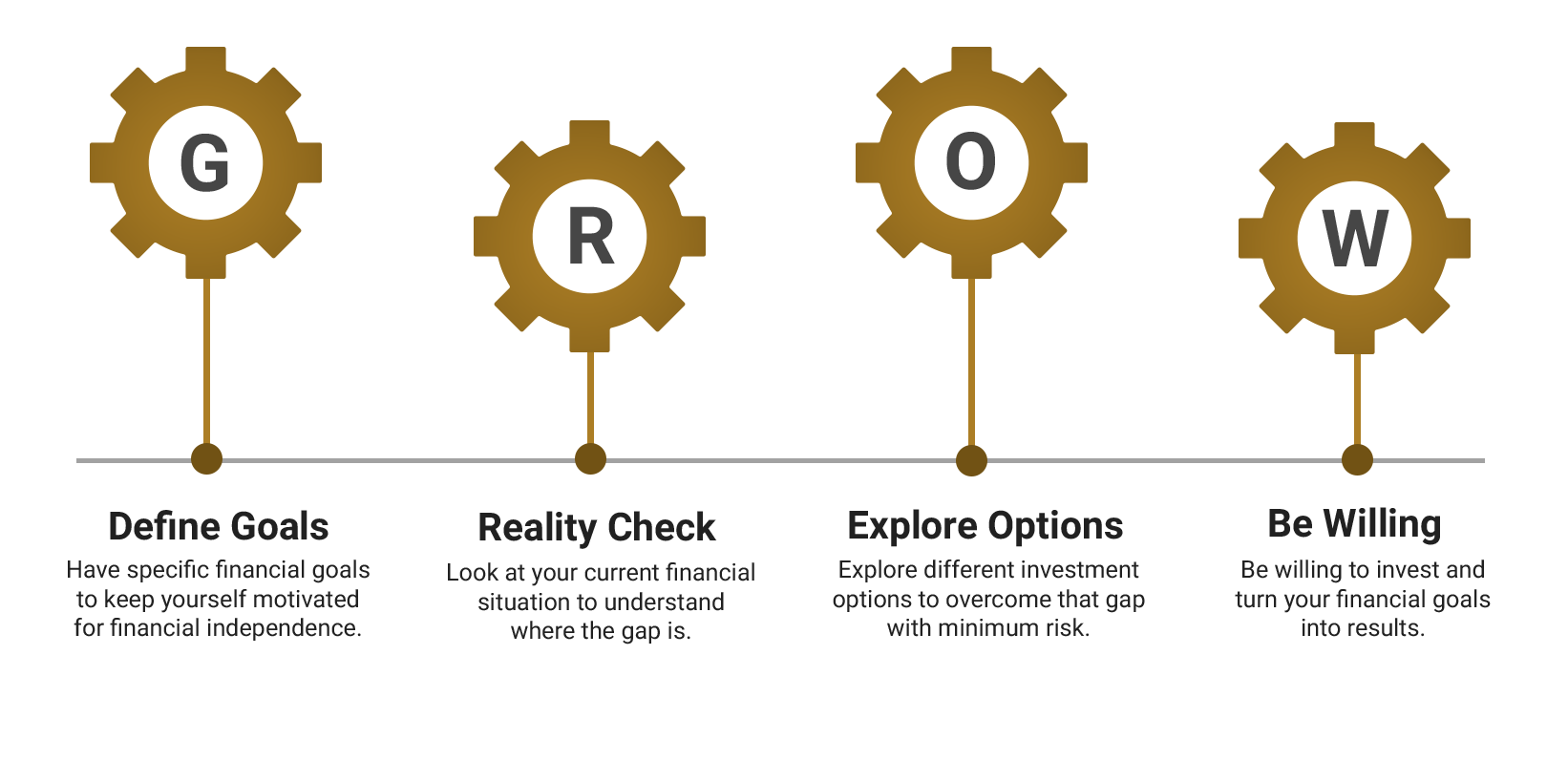

5 Mindset Shifts That Will Grow

5 Mindset Shifts That Will Grow  “Equity markets are risky and volatile and I’ll

lose my money”

“Equity markets are risky and volatile and I’ll

lose my money”

Equity markets can be risky and volatile in the

short term,

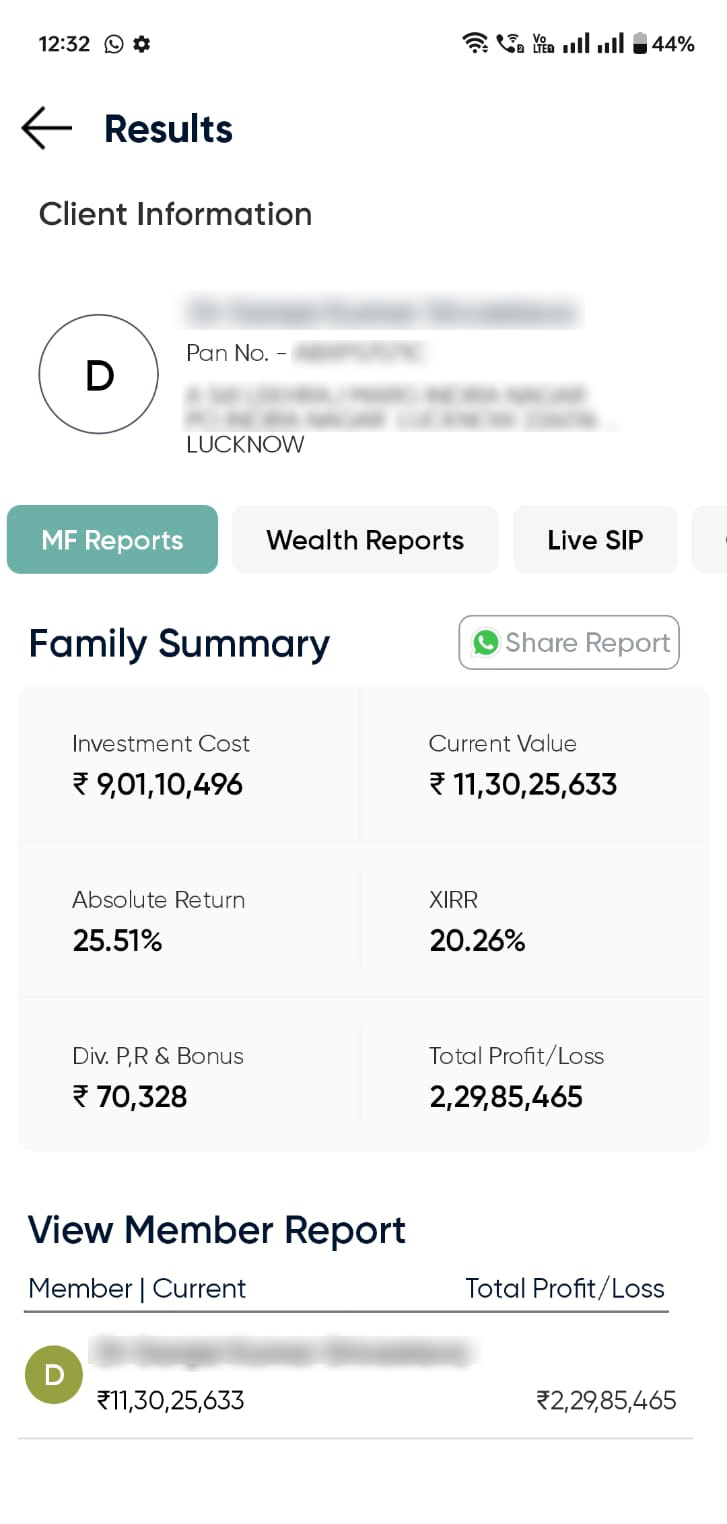

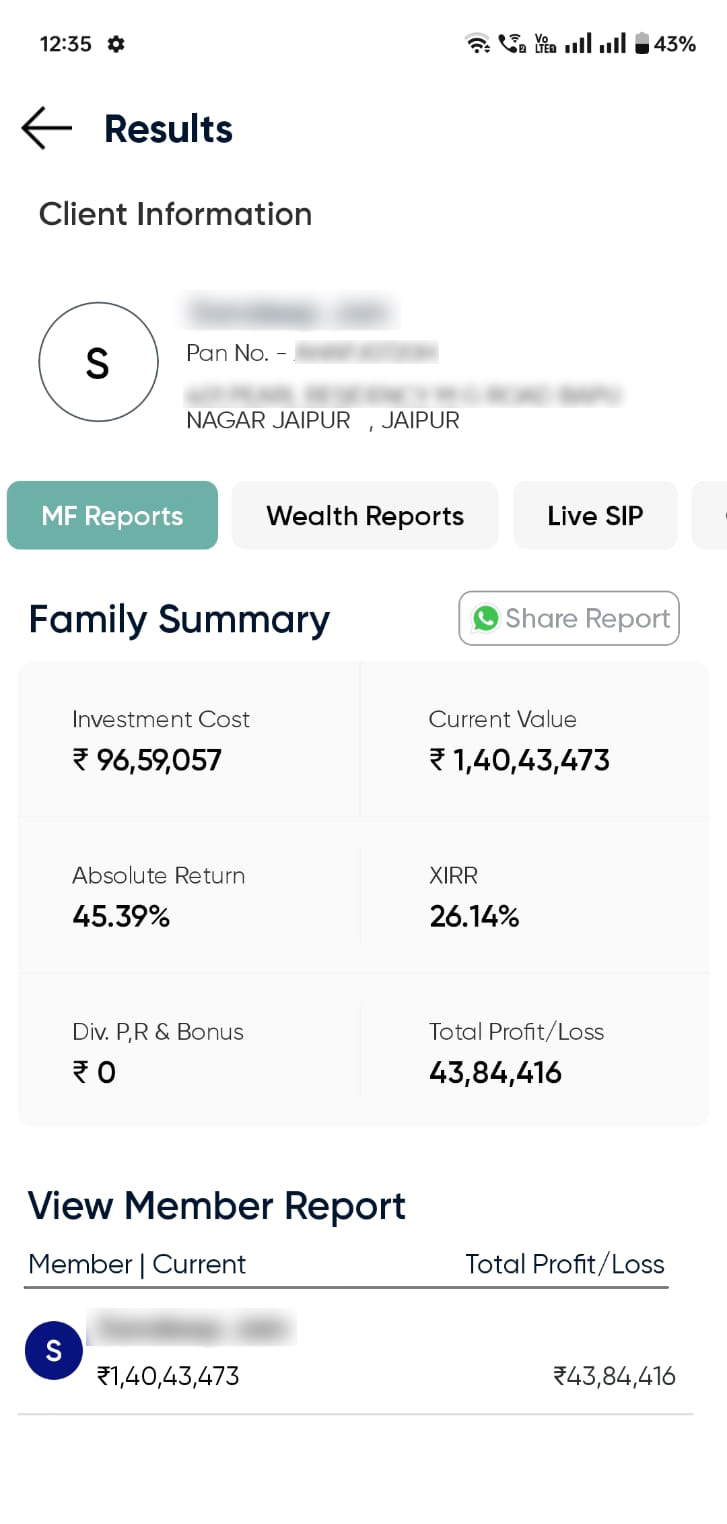

especially if you invest randomly. But if you invest strategically, they can give you exponential

returns over time.

Equity markets can be risky and volatile in the

short term,

especially if you invest randomly. But if you invest strategically, they can give you exponential

returns over time.

nvite Gaurav Jain To Speak

nvite Gaurav Jain To Speak